Managing your invoice-to-cash cycle doesn’t have to be complicated. Flywire helps B2B finance teams simplify payments, reduce friction, and maintain a steady cash flow. From invoicing to collections, we provide the tools to accelerate payments, no matter where you do business.

There’s a Better Way to Manage Your

Invoice-to-Cash Lifecycle:

AI-Powered Automation!

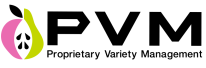

Invoicing & Billing

Accurate and efficient invoicing is crucial for maintaining a seamless payment process and robust cash flow. Flywire streamlines invoicing and billing, making it easier for customers to understand and complete payments.

Deliver branded invoices with smart payment links, flexible billing options, and complete visibility into payment status, giving customers a seamless experience from quote to cash.

- Automated Multi-Channel Invoice Delivery – Send invoices via email, postal mail, and more with built-in tracking for real-time visibility.

- Smart Payment Links – Embed secure payment links directly in invoices for faster, frictionless transactions.

- Customizable Templates – Maintain brand consistency with professional, region-specific invoice designs.

- Seamless Customer Onboarding – Simplify sign-ups, quotes, and estimates for a transparent payment process.

- Flexible Billing Cycles – Offer subscription plans and payment options tailored to customer needs.

- Automated Dispute Management – Minimize delays with built-in tools for handling disputes, deductions, and credits.

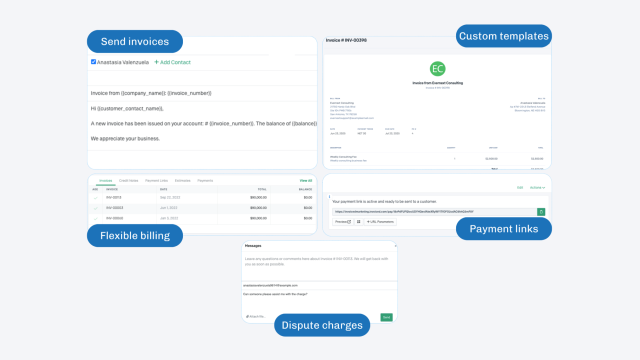

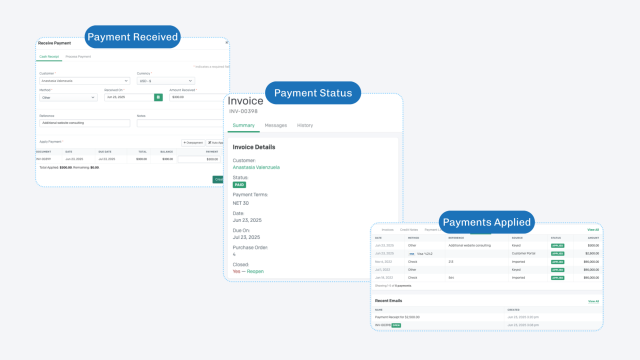

Proactive Accounts Receivable Management

Staying ahead of outstanding invoices is essential for financial stability. Flywire offers tools to streamline collections, enhance cash flow, and mitigate the risk of bad debt.

Automate reminders, track aging invoices in real time, and assign tasks to your team—all in one place. Proactive collections made simple.

- Automated, Branded Reminders – Engage customers with timely, multi-channel payment reminders.

- Task Assignment Features – Assign follow-ups to team members, ensuring no overdue invoice is overlooked.

- Real-Time Aging Analysis – Monitor invoice aging trends to identify risks and prioritize collections.

With Flywire, businesses can accelerate collections, minimize bad debt, strengthen customer relationships, and increase operational efficiency.

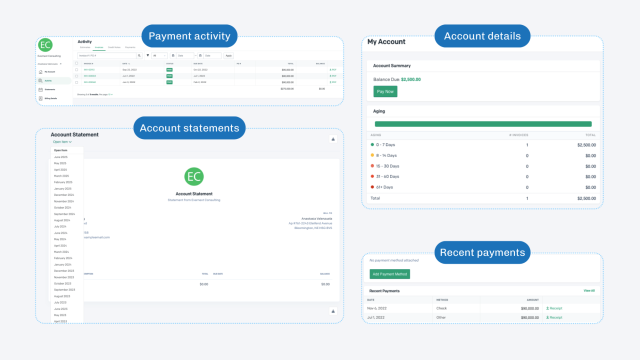

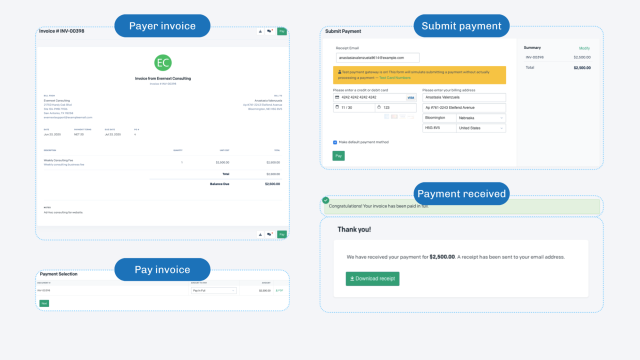

A Frictionless Payment Experience for Customers

A seamless payment experience improves customer satisfaction and collection rates. Flywire makes it easy for customers to pay, no matter where they are.

Make it easy for customers to pay their way, with a branded, flexible, and globally accessible payment solution backed by 24/7 support.

- Branded Payment Portal – Customizable to match your brand with language, currency, and payment method preferences.

- Extensive Global Payment Network – Access 1,200+ local payment options for a familiar and convenient experience.

- Flexible Payment Options – Offer installment plans, real-time tracking, and accessible payment history.

- 24/7 Multi-Channel Support – Ensure customers receive assistance whenever they need it.

By simplifying payments, Flywire enables businesses to enhance customer relationships and expedite revenue collection.

Built-In Global Payment Processing

Managing global transactions doesn’t have to be complex. Flywire offers a fully compliant and efficient payment network that reduces costs and operational hurdles.

Turn payments into a loyalty-building moment with an embedded, localized experience.

- Local Payment Processing – Process international payments without opening new bank accounts.

- 140+ Currencies with Competitive FX Rates – Avoid FX risks while ensuring seamless cross-border transactions.

- Optimized Payment Routing – Speed up settlements with intelligent transaction processing.

- Real-Time Payment Tracking & Fraud Prevention – Maintain security and compliance with built-in monitoring.

- ERP System Integration – Automate reconciliation and financial reporting across all payment types.

Flywire’s global payment infrastructure enables businesses to scale operations efficiently while maintaining compliance and security.

AI-Powered Cash Application

Manual cash application is time-consuming and prone to errors. Flywire’s AI-driven automation optimizes reconciliation and improves cash flow management.

No more guesswork. Know where each payment belongs.

- Custom Matching Rules – Configure payment matching based on your unique business logic.

- Real-Time Validation & Exception Handling – Identify and resolve discrepancies instantly.

- Automated Remittance Processing – Capture and process remittances without manual intervention.

- Direct ERP Posting – Ensure accurate, up-to-date financial records with seamless ERP integration.

By leveraging AI and automation, Flywire reduces operational costs, enhances financial visibility, and accelerates cash application.

Invoice-to-Cash Solution FAQs

What is Flywire's invoice-to-cash solution?

Flywire provides an end-to-end platform that automates invoicing, collections, global payment processing, and cash application. It’s designed to help B2B companies improve cash flow, reduce manual work, and enhance the customer payment experience.

How does Flywire help improve collections?

Flywire automates multi-channel payment reminders, assigns follow-ups to team members, and provides real-time invoice aging insights. These tools help your team stay proactive, minimize overdue invoices, and reduce bad debt risk.

Can Flywire handle global payments?

Yes. Flywire supports payments in 140+ currencies through a network of 1,200+ local payment methods. You can process international payments without opening new bank accounts and access competitive FX rates with built-in real-time tracking and fraud prevention.

What integrations does Flywire support?

Flywire integrates directly with leading ERP systems, including NetSuite, Sage Intacct, and Microsoft Dynamics, to automate reconciliation, remittance processing, and financial reporting. This ensures a seamless flow of data across your finance stack.

Is Flywire's payment portal customizable?

Absolutely. The branded payment portal can be tailored to your brand, language, currency, and payment preferences. Customers can track payment history, use installment plans, and access 24/7 multi-channel support.

Can Flywire automate invoice delivery and billing?

Yes. Invoices with real-time delivery tracking can be sent via email, postal mail, or other channels. Smart payment links and customizable templates make the process frictionless and aligned with your brand.

How does Flywire help with dispute resolution?

Flywire includes tools to automate dispute management, enabling your team to resolve deductions and credits efficiently, thereby minimizing payment delays.

What kind of businesses benefit from Flywire's solution?

Flywire is ideal for global mid-market to enterprise B2B companies, especially those with complex billing needs, subscription models, or cross-border operations.

How does the AI-powered cash application work?

Flywire uses AI to automate payment matching, remittance processing, and ERP posting. It applies custom logic to reconcile real-time payments and flags exceptions for quick resolution, saving hours of manual effort.

What kind of support does Flywire offer?

Flywire offers 24/7 customer support across multiple channels for both your team and payers, ensuring a seamless and responsive payment experience.

Get a demo

One of our experts will reach out to learn more about your payment challenges and show you how Flywire can help.