International expansion is top of mind for many CEOs in 2022, for different reasons. Increasing geopolitical tensions, trade pressures and sanctions present a real risk to future growth strategies, and have CEOs rethinking cross-border operations to that end, according to recent research from EY.

While CEOs are adjusting investment plans, ⅔ report actually increasing cross-border investments. As one guiding consideration in managing new opportunities, EY recommends businesses “reconfigure internal processes to strengthen operational resilience and the talent agenda.”

Let’s take one small, but important, slice of internal processes for international business – international business invoicing. We can all agree that it can be complex, especially issuing invoices to customers in certain countries. Even the most advanced and powerful ERP systems on the planet often require manual work when it comes to actually issuing a customer an invoice when there are unique regulatory, statutory or customer requirements for formats, local language and more.

As anyone who works in accounts receivable knows, this combination of systems that don’t talk to one another and manual processes make it challenging to get an accurate view of incoming cross-border payments, especially in one place, for the purposes of reconciliation. When you’re issuing invoices and collecting payments from multiple countries, in different payment types and often in different currencies, it can be difficult enough to run an AR aging report, let alone try to visualize data to find patterns and trends and see outliers. The lack of timely visibility into international cash flow hampers a business’s ability to understand actual performance, and inform future international expansion efforts.

To plan and adjust cross-border investment, you need information. And more, you need information that lends itself well to storytelling. In this case – how do our invoicing patterns tell our international expansion story, and can they inform its next chapter?

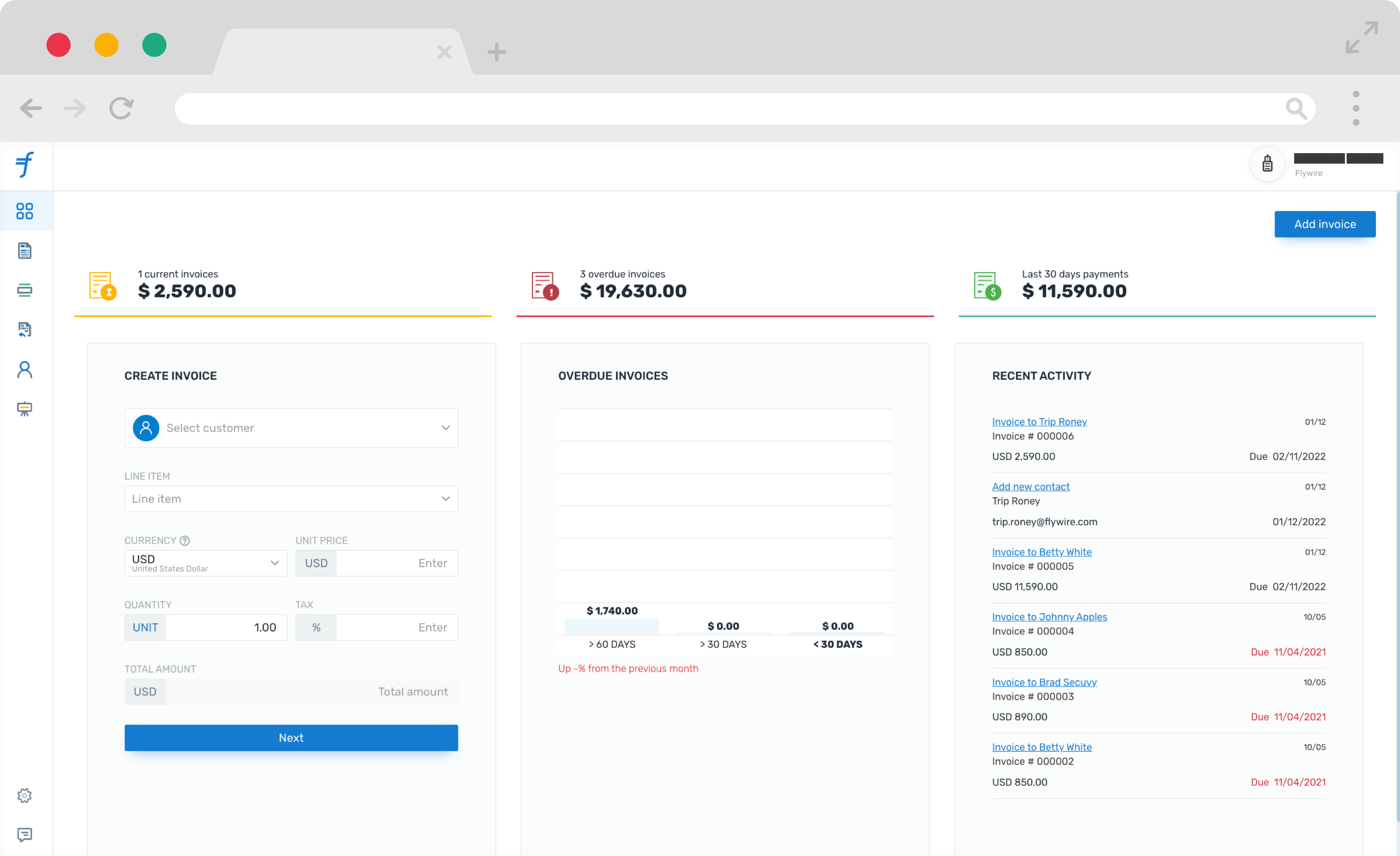

Flywire provides out-of-the-box dashboarding capabilities to visualize invoicing and payments data in several different ways. One of the major benefits of automating more of the international accounts receivable process is having access to data for analysis. Because payments and invoicing data is in one place, and you’re focusing only on the outliers, it’s easier to spot areas of high growth, learn about customers and dig into their payment patterns to do a range of things. This includes making more informed decisions on extending credit, advancing efforts to decrease DSO, and better predicting timing and amounts of cash flow.

B2B clients get a built-in, real-time view into payments received, initiated, aging, refunds and more by customer, country, and region. This helps them understand the real trends in their international business so they can make better decisions about future expansion and existing international revenue flows.

Let’s take a look at a few dashboards below.

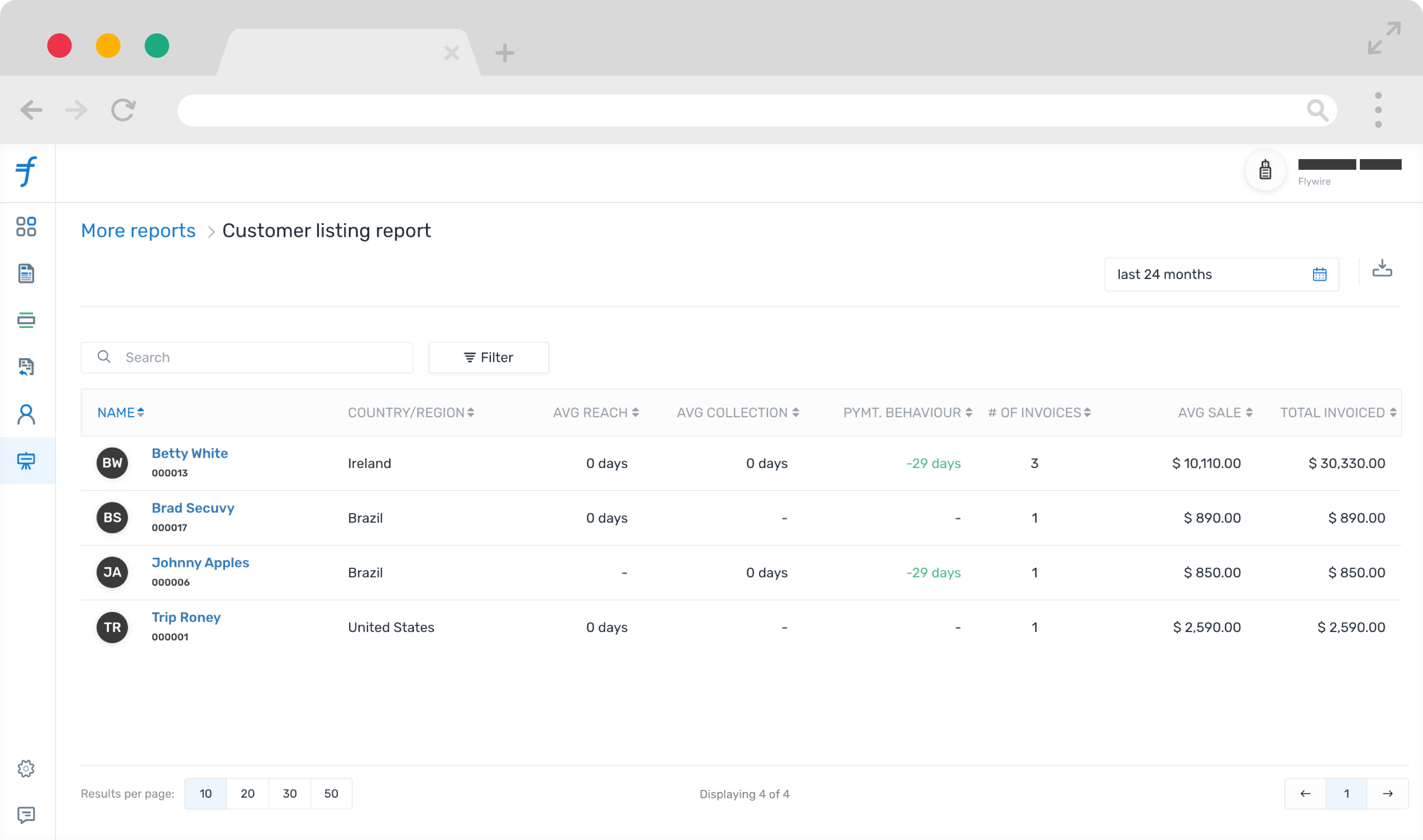

Reports are available with a few clicks, including a monthly invoice report, allowing you to easily see what’s been processed, what’s outstanding and more.

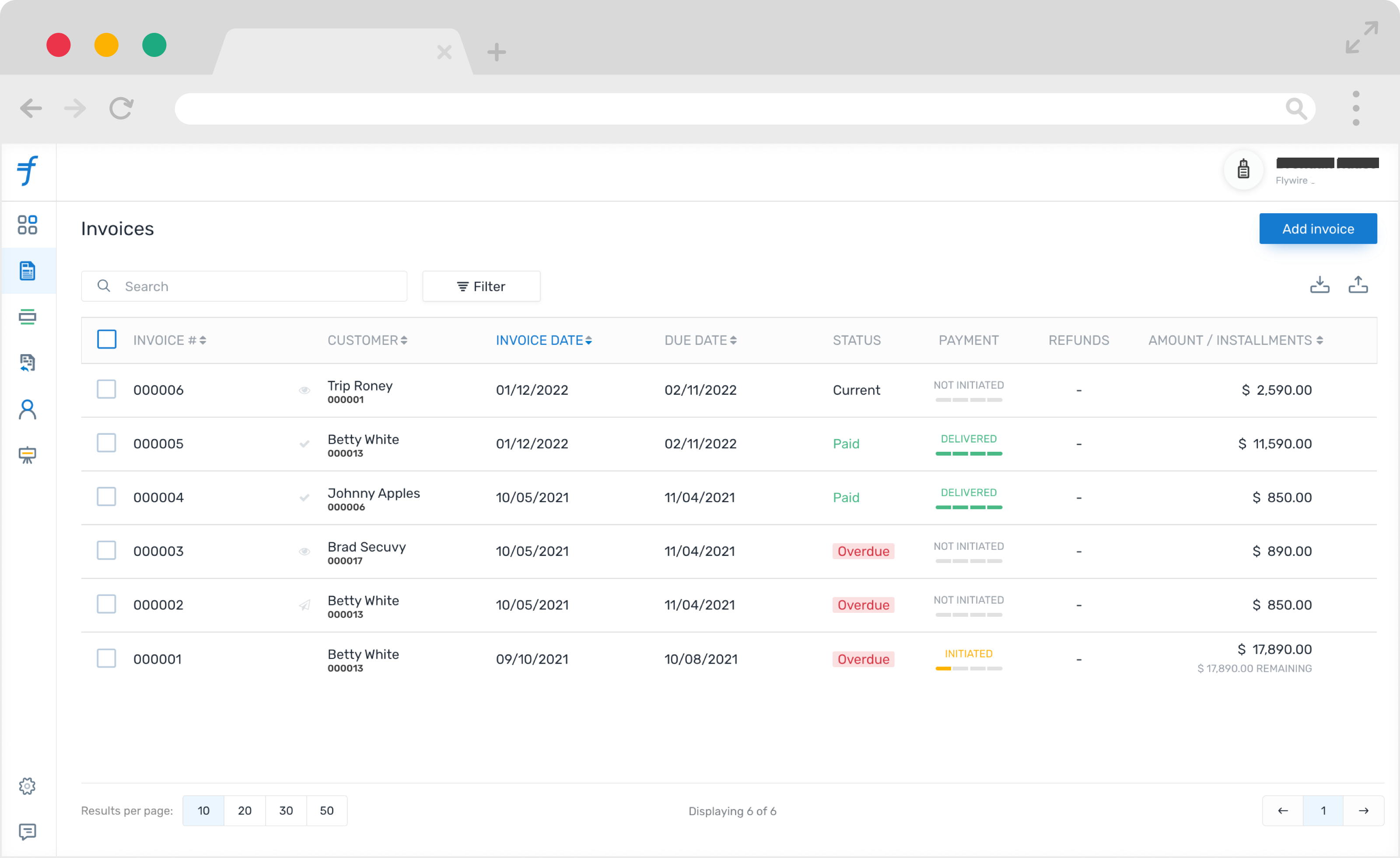

Easily view a breakdown of invoices by date, status of payment, total amount and more.

Get a quick overview of current, pending and overdue invoices.

Sometimes companies make the mistake of spinning up a legal entity overseas for the main purpose of getting paid by clients. What’s more, getting paid in an efficient way doesn’t just hinge on timing, but cost-efficiency. Find out what Flywire for B2B can do for your international invoicing and payments, starting with how much international receivables cost your business, and how much you could save.