There has not been much attention paid to the challenges companies face in managing accounts receivable across international borders. This was the inspiration for a survey recently commissioned by Flywire, “International A/R Management: Benchmarks, Challenges, Technology, Opportunity." In the wide-ranging survey, we look at the perspectives of 263 companies that manage accounts receivable across at least two different international borders.

I’ll give a preview of some of the survey results and key inferences related to how the companies surveyed are measuring and “managing to” A/R metrics. Note, “managing to” means measuring success relative to a set of metrics chosen by a company to define A/R success.

How are companies measuring international A/R success?

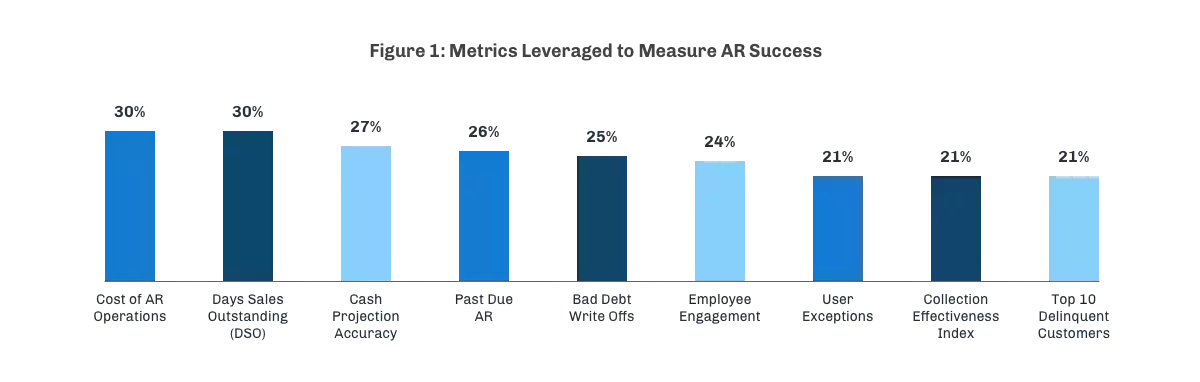

Identifying, measuring, and managing to the right A/R metrics is critical to optimize the value delivered from accounts receivable. Companies were asked to identify the metrics they use to measure AR success. The most commonly identified metrics are cost of A/R operations, days sales outstanding (DSO) and cash projection accuracy (Figure 1).

It’s encouraging to see that 24% of companies also identified employee engagement as an important AR success metric.Keeping and retaining the best talent is a key driver of A/R success, and it is good to see g that so many companies are leveraging a metric to ensure that the value of the right A/R talent is always on the radar.

Coming in at no. 3, the cash projection accuracy metric speaks to the growing importance of collaborating with treasury to deliver predictability of cash inflows to manage working capital.

What are the biggest challenges in managing international A/R?

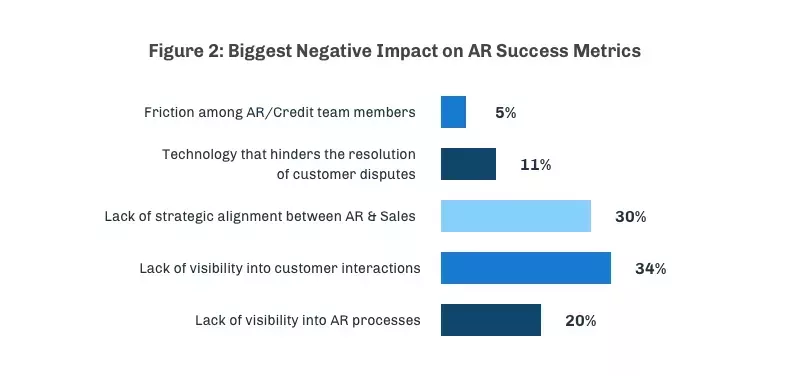

To gauge the challenges and opportunities in managing international accounts receivable, we asked companies to share what they believe to be the biggest obstacle they face. At least 30% of companies indicated that a lack of visibility into customer interactions (34%) or a lack of strategic alignment between A/R and sales (30%) has the most significant impact on their A/R success metrics. Some 64% of companies identified an issue related to visibility into A/R processes or interactions with customers as their biggest challenge in managing to their company’s A/R success metrics (Figure 2).

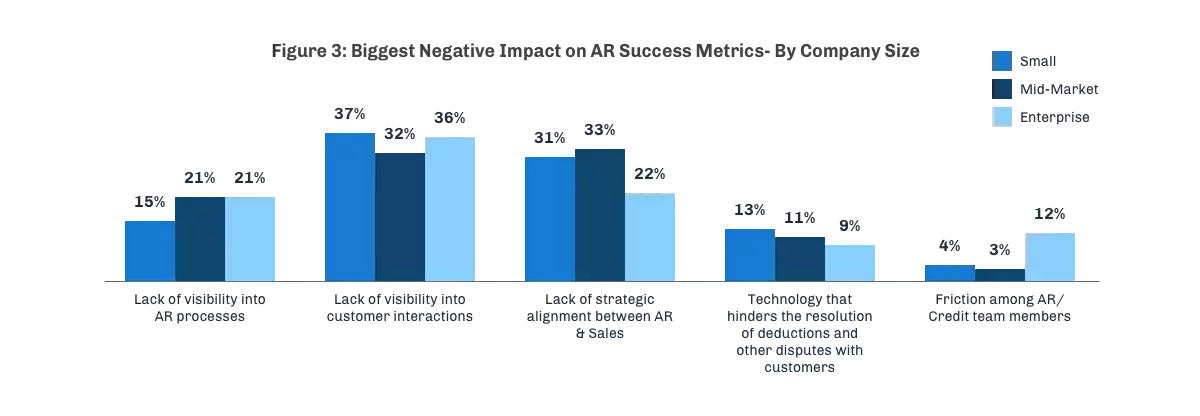

Challenges differ by company size: The results depicted in Figure 2 were analyzed relative to company size in terms of the number of employees (Figure 3).

Enterprises experience more friction among A/R team members than small and midmarket companies. 12% of enterprises (1,000+ employees) named friction among A/R team members as their biggest challenge, compared to only 3% and 4% at mid-market and small companies, respectively.

Midmarket and small companies need better alignment between A/R and sales. Strategic alignment of AR and sales was only identified by 22% of enterprise companies versus 33% and 31% of mid-market (100-1,000 employees) and small companies (less than 100 employees), respectively. Over one-third of enterprise companies have collaboration issues that are the biggest obstacle to AR success.

To improve DSO, companies look to customer collaboration, better solutions for invoice disputes

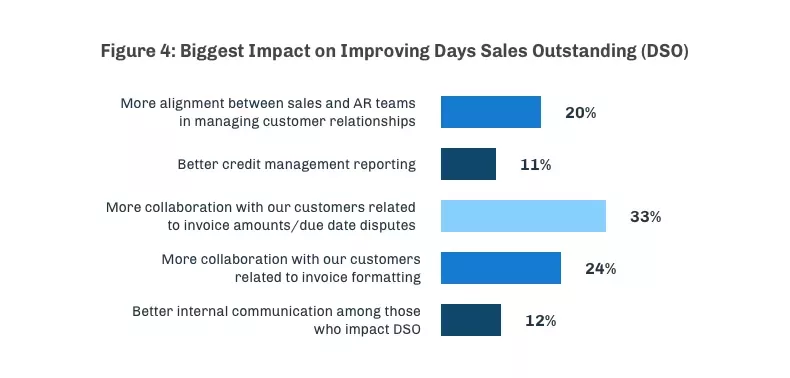

Days sales outstanding (DSO) always has, and still is, a metric that is among the top two metrics used in measuring A/R success in surveys dedicated to accounts receivable. Companies were asked to identify which factor that impacts their DSO they could improve that would have the biggest positive impact on their DSO (Figure 4).

Better collaboration with customers relative to resolving invoice/due dates disputes or invoice formatting was identified as this factor at 56% of survey respondents. Some 20% of companies shared that better alignment between A/R and sales would have the largest impact on improving their DSO. Improving collaboration within A/R and with customers would have a big impact on improving DSO for over ¾ of survey respondents.

DSO challenges differ by country

The next level of analysis of the challenges faced by the companies surveyed is relative to the countries/areas in which companies are managing accounts receivable. Companies were asked to share in which countries/areas in which they manage accounts receivable. In order to determine where to focus this analysis, companies were asked to share the country/area in which they had the most difficulty managing accounts receivable. Mexico, the United Kingdom (UK) and Canada were each identified by at least 10% of companies. Therefore, when results relative to country/area the focus will be on companies that manage accounts receivable in these countries/areas.

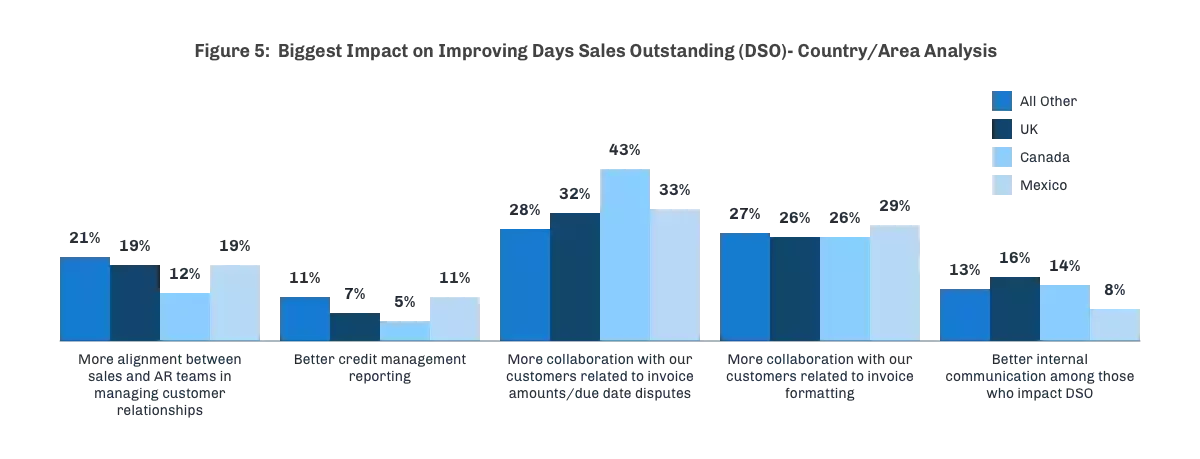

An analysis was done to determine if companies that managed accounts receivable in certain countries/area had a relatively different factor that would have the largest impact on the company’s DSO (Figure 5). Only 12% of companies that manage accounts receivable in Canada identified better alignment between sales and AR in managing customer relationships as the factor compared to those that have (or also) manage accounts receivable in Mexico (19%), UK (19%), or the counties/areas other than Mexico, Canada, or the UK (21%) (All Other).

Three other compelling results among those depicted in Figure 5 include:

- Companies with accounts receivable in Canada face a larger obstacle relative to invoice amounts/due dates disputes than companies that do not manage A/R in Canada.

- Companies with accounts receivable in Mexico face a less significant obstacle in managing DSO related to internal communication issues among those that impact DSO.

- Companies with accounts receivable in Canada face a less significant obstacle in managing DSO relative to credit management reporting among factors that impact their DSO.

Four recommendations for better international A/R processes

- The prevalence and magnitude of A/R challenges vary depending on which areas of the world companies are doing business. Companies need to understand the specific challenges that doing business across each international border creates and/or magnify relative to managing accounts receivable.

- Companies need to understand and invest in mitigating any silos that exist within their AR teams. Silos exist in companies of all sizes and create a productivity drag that increases the cost of A/R operations and damages customer relationships.

- Companies need to invest more in improving communication between A/R team members and their customers. Communication issues lead to collaboration issues. Invoice formatting and amount disputes, deduction misalignment, and headwinds in getting paid consistently within invoice terms are mitigated when companies empower A/R team members to build relationships with customers.

- Companies need to prioritize mitigating the misalignment of A/R and sales in managing customer relationships. Misalignment between A/R and Sales fuels inefficiency and creates issues with customers that impact the bottom line.

To receive a copy of the full report, “International A/R Management: Benchmarks, Challenges, Technology, Opportunity,” when it is released, please sign up here.

Ernie Humphrey

CEO, 360 Thought Leadership

Ernie Humphrey serves as the CEO of 360 Thought Leadership Consulting & Treasury Webinars. Over the past three years Treasury Webinars has delivered thought leadership webinars to over 15,000 treasury and finance leaders across the globe. Ernie has extensive experience as a long-time treasury manager and previously served as the Director, Treasury Services at the AFP.

Ernie was a driving force behind Proformative, formerly the largest community of Finance professionals, which grew from 500 to30,000 during his tenure. He has authored published articles on working capital management, performance management, budgeting & planning, acquisition integration, and bank relationship management in addition to articles dealing with several aspects of professional development.

Ernie's e-book focused on career management was recognized as one of the Top 10 e-books for CFOs in 2018. Ernie was named one of the Top 20 Pioneering CEOs by Tech Magazine in 2020. Ernie has a BS and MS in Economics both from Purdue University, and is an active mental health advocate.